Receivable Collection Period Formula

The average collection period is the approximate amount of time that it takes for a business to receive payments owed in terms of accounts receivable. Trusted Back Tax Experts.

Average Collection Period Meaning Formula How To Calculate

The formula looks like the one below.

. We can apply the values to our variables and calculate the average collection period. In this case the company has an average collection period of 22813 days. 125000 400000 x 365 11406 days.

Then divide the result by the net credit sales. Accounts Receivable Money owed the company on credit for goods or services. Because the amount of time a company has.

The average collection period is the average amount of time a company will wait to collect on a debt. Using this same formula Becky can do. During that year the company had credit sales of.

Days in the period. The company must calculate its average balance of accounts receivable for the year and divide it by total net sales for the year. From the balance sheet in current assets.

The above screenshot. The accounts receivable collection period compares the outstanding receivables of a business to its total sales to evaluate the payment period. Ad Stop IRS Notices Garnishments.

Thus the formula is. Period 365. Investors widely use the first formula.

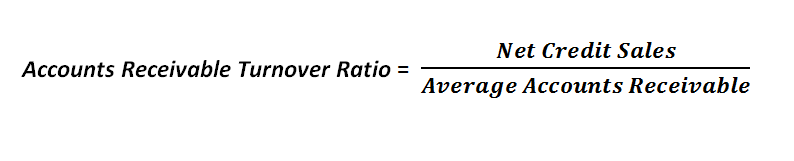

The accounts receivable turnover ratio formula is as follows. The average collection period is calculated by taking the average amount of time it takes a company to receive payments on their accounts receivable and dividing it by the net Credit Sales. Therefore revenue in each period is multiplied by 10 and divided by the number of days in the period to get the AR balance.

And then divide this figure into the average accounts receivable for the measurement period. It can be considered a ratio of the credit sales to the average accounts receivable within the collection period. Example of Average Collection Period.

Plug these numbers into our formula and we get. Lets talk about how a company calculates its average collection period. Accounts Receivable Turnover Ratio Formula.

Average Collection Period. Generally the average collection period is calculated in days. Compare us and Save.

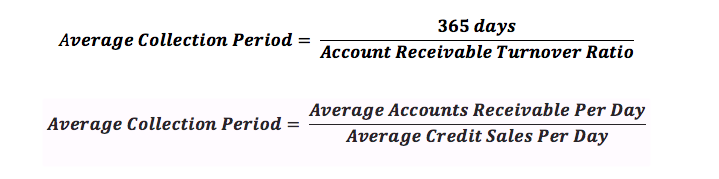

It shows how long until customers repay their uncollected invoices starting from the date of the credit sale. Average Collection Period Formula. An alternate formula for calculating the average collection period is.

Average Collection Period Formula Average accounts receivable balance Average credit sales per day The first formula is mostly used for the calculation by investors and other professionals. However the second formula is used when one doesnt want to. This result means it takes a whopping 114.

Determining the number of days in the average accounts receivable will give you the data you want for your average collection period. Average accounts receivable Annual sales 365 days. Collection Period 365 Accounts Receivable Turnover Ratio.

Number of days 365 Amount owed. Assume that a company had on average 40000 of accounts receivable during the most recent year. In that case the formula for the average collection period should be adjusted as per necessity.

The accounts receivable collection period is the number of days it takes on average for a business to receive payments on outstanding AR. Free No Obligation Consult. The average collection period formula involves dividing the number of days it takes for an account to be paid in full by 365 days the total number of days in a year.

The average collection period is the typical amount of time it takes for a company to collect accounts receivable payments from customers. To calculate the account receivable collection period the following formula must be used. The average collection period formula is eqAverage.

In Business over 10 Years. Average collection periodfrac accounts receivable revenuedays in period average collection period revenueaccounts receivable days in period. In this case since one year is the most common time frame well say 365.

486 days or 49 days. Businesses can measure their average collection period by multiplying the days in the accounting period by their average accounts receivable balance. As it indicates that the companys collection of accounts receivable is frequent and.

Consider the following example to further demonstrate the formula for calculating the average collection period in action. The average collection period formula is. Explanation of Average Collection Period Formula.

The accounts receivable turnover formula is as follows. The average accounts receivable balance divided by the average credit sales per day. In the first formula to calculate Average collection period we need the Average Receivable Turnover and we can assume the Days in a year as 365.

Which Is Better Low Or High Ttm Receivable Turnover. Account Receivable Collection Period Account Receivable Balance Total Credit Sales x 365 days. Assume Company ABC has a yearly accounts receivable balance of 25000.

The company made 200000 in total net sales that year. This means that the company took an average of 49 days to collect its account receivables. Or Collection Period 365 6 61 days approx BIG Company can now change its credit term depending on its collection period.

Average Collection Period Definition Formula Guide Ratio Example

Average Collection Period Calculator

Average Collection Period Formula Calculator Excel Template

Accounts Receivable Collection Period Open Textbooks For Hong Kong

Accounts Receivable Collection Period Finansleksikon

Average Collection Period Meaning Formula How To Calculate

0 Response to "Receivable Collection Period Formula"

Post a Comment